US Dollars Rate Black Market - What You Need To Know

Many people are curious about how money works outside official channels, especially when it comes to the value of the dollar in unofficial places. You might hear talk about different exchange rates or where people trade money without banks. This informal way of exchanging money can be a big topic for folks trying to make sense of their finances or just trying to understand how things really operate with currency in various spots around the globe.

It's a subject that touches on how governments manage their money systems and how people react to those rules. Sometimes, when it's hard to get foreign money through regular banks, people look for other ways. This creates a kind of unofficial market where dollars might trade for a different amount than what you see on official bank signs, so.

This piece will walk through some basic ideas about what the dollar is, how it moves around the world, and why these unofficial markets might pop up. We'll look at the dollar's role in global trade, like for oil, and how it came to be such a widely used form of payment, pretty much.

- Georgina Rodríguez Nude Pic

- Agathas Onlyfans

- Pancakes 1 Wantan Works

- Julia Filippo Vids

- Brandy And Billy Leaked Video

Table of Contents

- How Does the Dollar Work in Global Trade?

- What is the Dollar Sign and Its Meaning?

- Where Do Dollars Come From and Who Controls Them?

- What Makes the US Dollar So Important in the Black Market?

- Understanding Dollar Rates Outside Official Channels

- The Dollar as a Historical Coin and Modern Money

- Keeping Up with the Dollar's Value and News

- The Global Reach of the Dollar Beyond the US

How Does the Dollar Work in Global Trade?

The dollar, especially the one from the United States, plays a very big part in how countries buy and sell things to each other across the world. Think about it this way: when one country wants to buy oil from another, or perhaps some raw materials, they often use US dollars to pay for it. This is a common way to settle accounts, you know, between different nations. It makes things simpler because everyone generally accepts this one kind of money, so.

This means that even if a country doesn't use the dollar as its own daily money, its businesses might still need a lot of dollars to do their buying and selling on a global scale. It's almost like a common language for money when goods move from one place to another. Because so many deals happen this way, the dollar is always moving around the world, going from one country's bank to another's, pretty much.

The fact that oil and other important goods are often priced in dollars makes it a very important form of payment. If a country needs oil, it needs dollars to get it. This constant need for dollars in world trade gives the currency a lot of standing and makes it something many people want to hold onto. It’s a bit like a universally accepted coupon for important stuff, you see.

- Dee Dee Blanchard Crime Scene Photos

- Breckie Hill Porn Leaks

- Deonna Purrazzo Leaked

- Onlyfans De Gloria Torres

- Bella Poarch Leak

This also means that if there's a place where dollars are hard to get through regular channels, people might look for other ways to find them. This can sometimes lead to informal markets where the dollar is traded. The basic need for this money for global buying and selling drives a lot of its demand, both in official places and in those other spots, actually.

What is the Dollar Sign and Its Meaning?

You see the dollar sign, that '$' symbol, all over the place. It's a very common mark for money in many parts of the world, but it's most famous for representing the United States dollar. When you see '$20', it means twenty dollars. This simple mark helps everyone quickly understand what kind of money amount is being talked about, you know, when they see it written down.

This sign is used for different kinds of money in various countries. For example, Canada and Australia also have currencies called dollars, and they use that same symbol. So, it's not just for the US, though that's the one most people think of first. It's a widely recognized symbol that stands for a unit of value, basically.

The dollar sign helps people quickly identify amounts of money in written form. It's a shorthand way to show what kind of currency is being discussed. This common symbol makes it easier for people to communicate about money, whether they are talking about prices in a store or the cost of something in a larger financial deal. It’s a simple visual cue, so.

The symbol itself has a bit of a story, though we don't need to get into all the details here. What matters is that it's a clear signal that you're dealing with a dollar-based currency. This clear symbol helps avoid confusion, which is important when money is changing hands, especially when people are dealing with dollars rate black market situations, you know, where clarity might be less common. It helps to have that familiar sign, anyway.

Where Do Dollars Come From and Who Controls Them?

The US dollar is created and managed by something called the Federal Reserve. This is the central bank of the United States. Think of it as the main money manager for the country. It's a part of the US system, but it operates with a certain level of independence to make decisions about money, you know, without too much day-to-day political influence. So, it's the place that decides how much money is out there, more or less.

The United States government itself has a way of getting a lot of money from groups and people all over the world. It does this by borrowing. When the government needs money for its projects or to pay its bills, it can ask for money from global financial groups, and these loans are often made in US dollars. This means that the dollar is not just used for buying things, but also for big financial deals between countries and governments, pretty much.

The Federal Reserve issues these dollars. They are the ones who print the paper money and manage the digital money that moves around. They have a big say in how much money is in circulation and what the cost of borrowing money is. These actions affect the dollar's value and how it acts in the world. It’s a very important job, you see.

Because the dollar is so widely used and accepted, the way the Federal Reserve manages it has effects far beyond the United States. Its decisions can influence prices and money values in many other countries. This is why people pay attention to what the Federal Reserve does, as it can affect how the dollar is seen, even in places where there might be a dollars rate black market, actually.

What Makes the US Dollar So Important in the Black Market?

The US dollar holds a very special place in unofficial money exchanges, often called the dollars rate black market, for several reasons. One big reason is its widespread acceptance and the fact that it's seen as a very safe form of money. In places where the local currency might be losing its value quickly, or where there's a lot of economic uncertainty, people often prefer to hold onto US dollars. It’s a bit like a safe place for their savings, so.

Another point is that the dollar is used for a lot of international trade, as we talked about. If businesses in a country need to buy goods from outside, and their own money isn't accepted, they will look for dollars. If the official banks or money changers can't provide enough dollars, or if the rules for getting them are too strict, people will then look for other ways to get their hands on this money. This creates a demand in unofficial channels, you know.

Sometimes, governments have rules that limit how much foreign money people can get or send out of the country. These rules are put in place for different reasons, but they can make it hard for regular people or businesses to get the dollars they need through official means. When this happens, an unofficial market can grow to fill that need, offering dollars, but often at a different price than the official rate, pretty much.

The dollar is also a currency that people trust to hold its value over time, more so than many other currencies, especially in times of trouble. This trust makes it a desirable item for anyone looking to protect their wealth or to make sure they can still buy things from other countries. This strong desire for dollars is a key reason why it becomes such a central player in the dollars rate black market, you see, in many parts of the world, anyway.

Understanding Dollar Rates Outside Official Channels

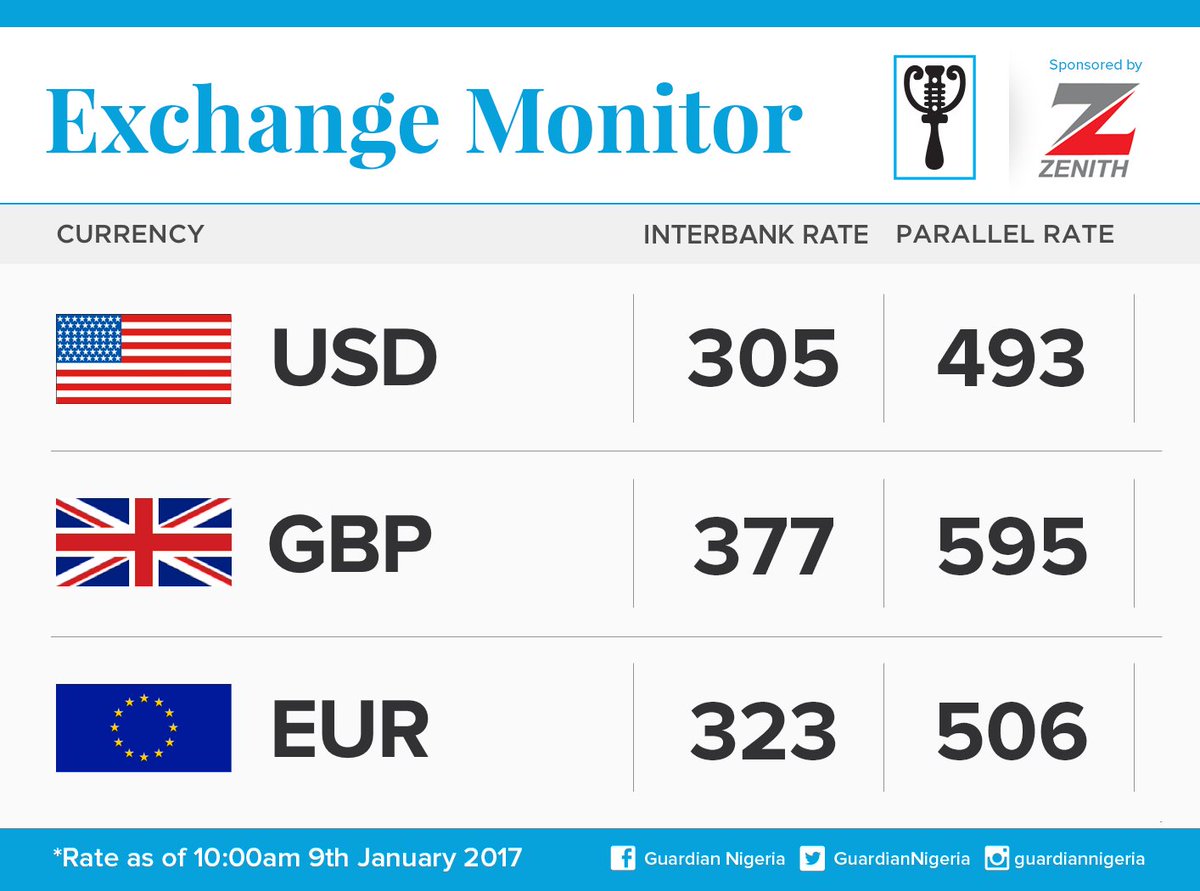

When we talk about dollar rates outside official channels, we are essentially looking at how the US dollar is valued in informal settings. This is different from the rates you would see at a bank or an official money exchange office. In these unofficial places, the price of the dollar against the local money can be quite different, sometimes higher, sometimes lower, depending on many things, so.

These unofficial rates, often linked to the dollars rate black market, are set by what people are willing to pay and what people are willing to sell for. If many people really need dollars and there aren't enough available officially, the price for dollars in these unofficial spots can go up. It’s simple supply and demand, but without the official rules and oversight, you know.

Several things can make these unofficial rates move around. For example, if there's a lot of political unrest or economic problems in a country, people might lose trust in their own money and try to get dollars. This increased demand can push the unofficial dollar rate higher. Or, if a government suddenly makes it even harder to get dollars officially, that too can affect the price in the informal market, pretty much.

It's also worth remembering that these unofficial exchanges don't have the same protections as official ones. There might be risks involved for people buying or selling money this way. But for some, it's the only way to get the foreign money they need for various reasons, whether it's for travel, sending money to family, or buying goods from outside their country, you see. The way the dollars rate black market operates is very much about people finding ways around official limits, basically.

The Dollar as a Historical Coin and Modern Money

The word "dollar" actually has a long history, going back to a silver coin that was used in many parts of Europe a long time ago. So, the idea of a "dollar" as a unit of money isn't something new, it's been around for quite a while, you know, in different forms. This old history shows that the concept of a widely accepted silver coin was very useful for trade back then, too.

In our modern times, the name "dollar" is now the standard for the money in several countries, not just the United States. Canada, Australia, and New Zealand, for example, all use a currency called the dollar. This shows how a name from the past can be adopted and used in many different places around the world today, so.

The US dollar, as we know it now, is what's called a "fiat currency." This means its value isn't tied to something like gold or silver. Instead, its value comes from the trust people have in the government that issues it and the fact that it's accepted for paying taxes and debts. This is a big change from its silver coin beginnings, you see.

This historical journey, from a physical silver coin to a modern fiat currency, shows how money changes over time to meet the needs of people and trade. The dollar's long standing and its current wide use contribute to its importance, even in informal settings like the dollars rate black market. Its long history gives it a certain kind of weight, in a way, that people recognize and often rely on, anyway.

Keeping Up with the Dollar's Value and News

For anyone interested in money, especially the dollar, it's pretty helpful to keep an eye on its value and what's happening with it. There are many ways to get information about dollar rates, news, and facts. You can find tables that let you compare how much a US dollar is worth against all sorts of other currencies. These tables are often updated very often, so.

You can also find news about the dollar, which can help you understand why its value might be going up or down. Things like what the Federal Reserve decides, or what's happening in the global economy, can all affect the dollar's strength. Knowing these things can give you a better sense of how money is moving around the world, you know.

There are also specific ways to look at the dollar's overall strength against a group of other major currencies. One common way is through something called the US Dollar Index, or DXY. This index gives you a quick look at how the dollar is doing generally. It's a tool that many people who follow money markets use to get a broad picture, basically.

Keeping informed about the dollar is not just for big businesses or financial experts. It can also be useful for regular people who might be traveling, sending money to family in another country, or just trying to understand how global money matters might affect them. This information can also help people understand why the dollars rate black market might show different prices than the official ones, you see, because it reflects different pressures on the currency, pretty much.

The Global Reach of the Dollar Beyond the US

The US dollar is not just used in the United States. It's actually the most traded currency in the whole world. This means that more people and businesses exchange US dollars for other currencies than any other money. It's much more traded than, say, the Euro or the Japanese Yen, so. This very high level of trading shows just how important it is everywhere.

Beyond being traded, the US dollar is also used as the official money in some other countries outside of the United States. This means that in these places, you can use US dollar bills and coins just like you would in New York or Los Angeles. It makes it very easy for people from the US to visit these places, and it also shows how much trust these countries put in the dollar, you know.

We've talked about how it's the standard money for buying and selling important goods like gold and oil. This is a very big part of its global reach. When countries make deals for these items, the price is usually set in dollars, and the payment is made in dollars. This makes it a central piece of how global trade works for some of the most important things we use every day, pretty much.

So, the dollar's influence goes far beyond the borders of the United States. It acts as a kind of global money for trade, a safe place for savings, and even the official currency in some nations. This wide acceptance and use are key reasons why it's such a powerful force in the world's money systems, and why it's so sought after, even in informal settings like the dollars rate black market, you see. It’s a truly global form of payment, anyway.

Detail Author:

- Name : Zackery Christiansen

- Username : champlin.hilario

- Email : djast@will.com

- Birthdate : 2002-12-13

- Address : 7889 Nels Squares Suite 890 East Gladyce, FL 26527-4251

- Phone : +1-458-627-1558

- Company : Huel, Parker and Block

- Job : Production Worker

- Bio : Iure temporibus eius adipisci repudiandae aperiam consequatur. Voluptas deserunt id vero enim repudiandae voluptatem sequi.

Socials

tiktok:

- url : https://tiktok.com/@heaney2007

- username : heaney2007

- bio : Praesentium ipsam incidunt ut consequuntur.

- followers : 6110

- following : 2433

twitter:

- url : https://twitter.com/reginald2761

- username : reginald2761

- bio : Deleniti fugit beatae totam ut tempora. Repudiandae sapiente ab qui magni rerum delectus non. Ducimus aut culpa qui odit non beatae illo tempora.

- followers : 5715

- following : 2109

facebook:

- url : https://facebook.com/heaneyr

- username : heaneyr

- bio : Nulla eos repudiandae ut rem voluptatibus.

- followers : 3844

- following : 1821

instagram:

- url : https://instagram.com/heaneyr

- username : heaneyr

- bio : Aut culpa doloremque a saepe qui molestias. Officia ratione sequi eaque non.

- followers : 2725

- following : 2072