Networth - Your Financial Standing Explained

Figuring out your personal financial standing can feel like trying to solve a puzzle, but it really doesn't have to be. There is a single number, a very useful figure, that gives you a quick look at where you are right now with your money. This number, often talked about but perhaps not always fully grasped, is your networth. It is, quite simply, what you own, less what you owe to others. Knowing this one piece of information, you know, can make a significant difference in how you see your money situation.

It's not just for those who have a lot of money, or for big companies with many moving parts. No, everyone has a networth, whether they realize it or not. This figure, you see, provides a clear picture of your financial situation at a specific point in time, a sort of snapshot that captures all your assets and all your liabilities in one easy-to-grasp total. It's a way to get a quick sense of your overall money health, which is pretty useful, really.

This idea of networth is more than just a number on a piece of paper. It's a way to measure your progress, to see how far you've come, or how much more you might want to achieve. We'll talk about what makes up this figure, why it's something you might want to keep an eye on, and how it can actually help you make better choices with your money. It's all about getting a clearer picture, so you can feel more in control, and frankly, more at ease.

Table of Contents

- What is Your Networth, Anyway?

- The Pieces of Your Personal Networth

- Why Keep an Eye on Your Networth?

- How Can Networth Help You?

- What Does the Average Networth Look Like?

- Networth Tools for Your Pocket

- Does Your Networth Matter?

- Seeing a Positive Networth

What is Your Networth, Anyway?

So, what exactly is this thing called networth? Well, it's pretty straightforward, actually. Think of it as a simple math problem. You take everything you own that has some sort of monetary value, and then you subtract everything you owe to others. The result of that simple calculation is your networth. It's a way of looking at your personal finances that gives you a single, clear number, a bit like a temperature reading for your money situation. This figure, you know, captures all the valuable items you possess and takes away all the money you're still obligated to pay back.

The Pieces of Your Personal Networth

To break it down even further, your networth is made up of two main parts: your assets and your liabilities. Your assets are, in a way, all the good things, the items or holdings that add to your financial standing. This could be the money you have in your savings account, or the value of your home, or perhaps a car you own outright. It might also include things like investments you have, or even valuable possessions that could be turned into cash if needed. These are all the items that contribute to your financial well-being, the things that you can claim as yours. It's quite a broad collection of items, you see, that all play a part in painting your complete financial picture.

On the flip side, your liabilities are the things that take away from your financial standing. These are the debts, the money you still have to pay back to someone else. This includes things like the amount you still owe on your house, or any student loans you might have, or balances on your credit cards. Even car loans, you know, fall into this category. These are all the financial obligations that reduce the total value of what you truly possess. So, when you add up everything you own, and then take away everything you owe, you get that one telling number: your personal networth. It's a fairly simple idea, but it carries a lot of meaning for your money life.

Why Keep an Eye on Your Networth?

You might wonder why it matters to keep an eye on this particular number. Well, your networth acts like a financial report card, giving you a quick sense of how well you're doing with your money at any given moment. It’s like taking a photograph of your finances right now. This snapshot, you know, helps you see where you stand. It's not about being judged, but more about having a clear picture for yourself. This one piece of information can be incredibly helpful for understanding your overall money health, and frankly, it gives you a point of reference for where you might want to go next.

Beyond just seeing where you are, your networth is also a very good way to keep track of your forward movement. It's a single point of information that shows your progress over time. If you calculate it regularly, say once a year, you can see if that number is growing, shrinking, or staying about the same. Seeing that number change, especially if it's going up, can be a really encouraging thing. It shows that the choices you are making with your money, like paying off debt or saving more, are having a real effect. It gives you a way to measure your financial journey, which is pretty cool, if you think about it.

How Can Networth Help You?

Knowing your networth can actually help you in several practical ways, you know. For one thing, it can be a really good starting point for putting together a budget. When you see your total assets and liabilities, it gives you a clearer picture of your overall financial resources and obligations. This helps you decide how much money you can realistically set aside for different things, and where you might need to cut back. It helps you get a grip on your cash flow, which is pretty essential for any kind of money planning. It's a way to make sure your spending matches up with your larger money picture.

Furthermore, understanding your networth can encourage you to make better choices about how you spend your money. When you see how every purchase, or every debt, affects that overall number, you might think twice about certain expenditures. It can motivate you to pay down any money you owe, because you'll see that number, your liabilities, getting smaller, which in turn makes your networth grow bigger. This can be a very strong push to reduce your debts. It’s also, in a way, a source of motivation to keep working towards your money goals, whatever they might be. Seeing that number improve can really light a fire under you to keep going, which is a powerful thing.

What Does the Average Networth Look Like?

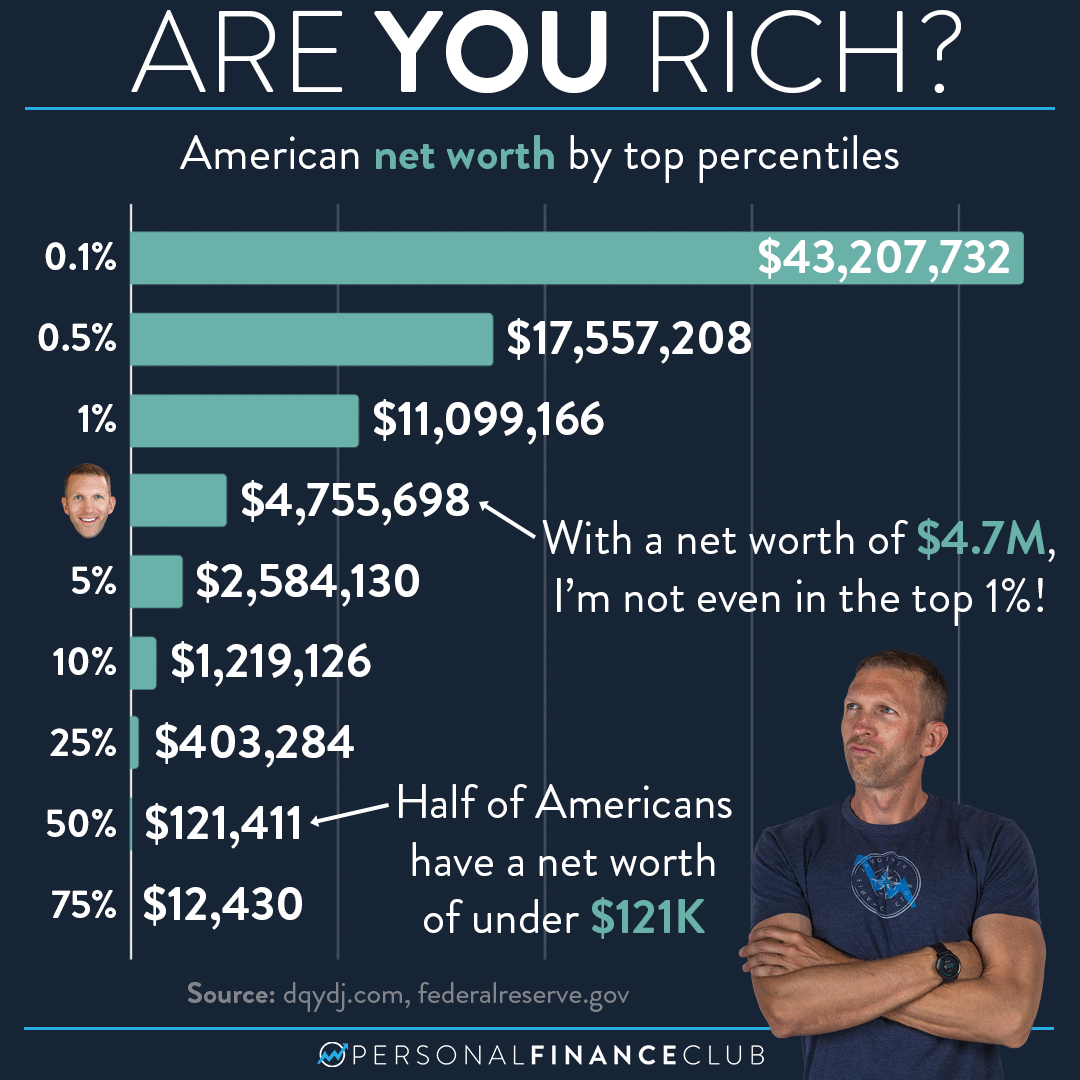

You might be curious about what other people's networth figures look like, just to get a sense of things. For instance, in 2022, the typical networth for all Americans was about $192,900. This number, known as the median, gives you a good idea of what the person right in the middle of the population has. It means that half of all Americans had a networth below this figure, and half had a networth above it. It's a pretty good way to see what is common for most people, without being skewed by a few very large numbers. It shows a sort of everyday reality for many households, which is quite interesting to consider.

However, there's another number often talked about, and that's the average networth. In 2022, the average networth was quite a bit higher, around $1.06 million. Now, you might wonder why there's such a big difference between the typical and the average. The reason, you see, is that the average number gets pulled way up by a few people who have extremely high networths. These very large fortunes make the average look much bigger than what most people actually have. So, while the average is a calculation, the typical, or median, is often a more useful figure if you want to understand what the majority of people experience financially. It gives you a more realistic benchmark, in some respects.

Networth Tools for Your Pocket

Thankfully, figuring out your own networth doesn't have to be a difficult task. There are tools available, like a networth calculator, that can help you put all the pieces together. These calculators simply ask you to list your assets and your liabilities, and then they do the math for you. It takes away the guesswork and gives you that clear number you are looking for. Using such a tool can make the whole process much simpler and less intimidating, which is pretty helpful for anyone just starting to get a grip on their finances. It's a straightforward way to get that initial snapshot.

Some online resources even let you track your networth over time, which is a really neat feature. You can enter your numbers regularly and see charts that show your progress, or perhaps where you might need to adjust things. Some platforms even let you share your networth anonymously, if you choose, and compare it with others. This can give you a sense of where you stand in relation to a broader group, without revealing your personal identity. These interactive features, you know, can make the process of managing your money a bit more engaging, and give you different ways to look at your financial picture. It's a pretty useful way to keep tabs on things, honestly.

Does Your Networth Matter?

So, does your networth really matter in the grand scheme of things? Well, in a way, it does. It's a helpful way to see your financial health at a glance. It gives you a simple, yet comprehensive, look at your money situation. This figure can help you measure your progress towards your money goals, whatever those might be. Whether you are aiming to pay off a certain amount of debt, or save up for a big purchase, or simply build a more secure financial future, your networth provides a clear indicator of how well you are doing. It's a personal scorecard that only you need to see, and it can be quite motivating, as a matter of fact.

It's important to remember that your networth is just one number, and it represents a moment in time. It doesn't tell your whole story, but it does tell a very important part of your money story. It can be a very good guide for making choices about your spending, your saving, and your debt repayment. It helps you understand the impact of your financial actions. Ultimately, knowing your networth gives you a greater sense of control and awareness over your money, which can lead to a feeling of greater security and peace of mind. It’s a pretty powerful tool for personal money management, in some respects.

Seeing a Positive Networth

One of the goals for many people is to have a positive networth. What does a positive networth mean? It simply means that the total value of everything you own is greater than the total amount of money you owe. This is, in a way, a very good sign of financial well-being. It suggests that you have more assets than liabilities, which puts you in a stronger financial position. A positive networth can indicate that you are building wealth over time, and that you are making choices that contribute to your financial growth. It's a pretty good feeling to see that number in the black, so to speak.

Having a positive networth can bring a sense of comfort and stability. It means you have a cushion, something to fall back on if unexpected things happen. It can also give you more options in life, like the ability to make certain purchases, or to pursue new opportunities, or even to retire comfortably one day. It’s a sign that your money is working for you, rather than you always working for your money. While the exact number will vary greatly from person to person, simply having a positive networth is, you know, a very good step in the right direction for anyone looking to build a more secure and prosperous financial future. It really is a key indicator of good money health.

This article has covered what networth means, how it is calculated by looking at what you own versus what you owe, and why it serves as a helpful snapshot of your financial standing. We've talked about how this single figure can be used to track your progress over time, and how it can motivate you to make better choices regarding budgeting, spending, and paying off debt. We also touched upon what typical networth figures look like for people, and how tools like calculators can make understanding your own networth much easier. Finally, we discussed the significance of having a positive networth and what that can mean for your financial security and overall well-being.

Detail Author:

- Name : Miracle Lebsack

- Username : providenci.hauck

- Email : adolfo.rau@yahoo.com

- Birthdate : 2001-03-22

- Address : 299 Ullrich Crossroad North Sonya, NC 63020-7400

- Phone : 1-848-716-5726

- Company : King, Kunze and Jast

- Job : Human Resource Director

- Bio : Iusto dolorem ut quia maxime. Est a et ea recusandae non atque aliquid. Delectus quibusdam eveniet voluptas et.

Socials

tiktok:

- url : https://tiktok.com/@kimkessler

- username : kimkessler

- bio : Ipsum quas repellendus est sit delectus explicabo natus sed.

- followers : 3232

- following : 2460

linkedin:

- url : https://linkedin.com/in/kim_id

- username : kim_id

- bio : Qui tempora quae dolores repellendus.

- followers : 5316

- following : 987